Formule Cashflow. Learn the formula to calculate each and derive them from an income statement, balance sheet or statement of cash flows). Free cash flow is cash left after a company pays operating expenses and capital expenditures.

In this video on free cash flow fcf, we are going to understand this topic in detail including its meaning, formula, calculation and examples.

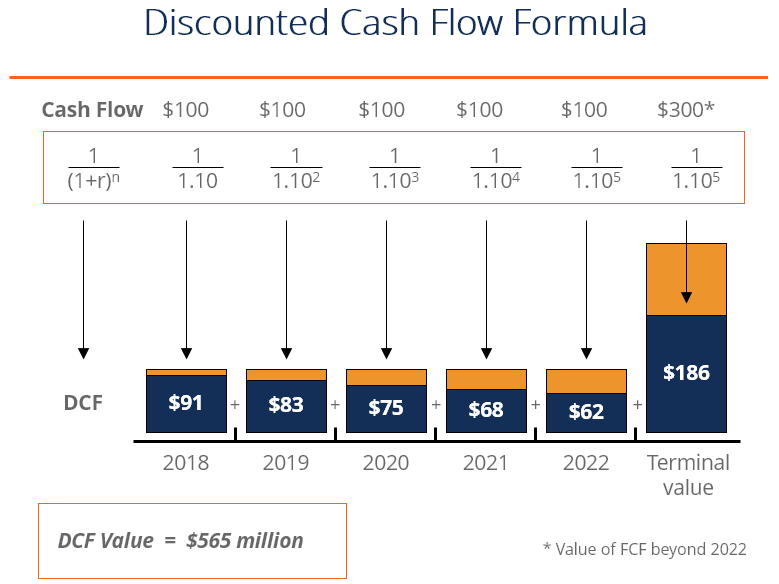

The formula for operating cash flow requires three variables: Since the discounted cash flow formula is based on assumptions, another method that could be used is the comparables method. Free cash flow is cash left after a company pays operating expenses and capital expenditures. In corporate finance, free cash flow (fcf) or free cash flow to firm (fcff) is a way of looking at a business's cash flow to see what is available for distribution among all the securities holders of a corporate entity.

No comments:

Post a Comment